This ONS decision is supported by Eurostat (the statistical physique of the European Commission) and much of the wider international statistical community. Knowing which scholar loans fit your situation finest and just how much money you’ll have to borrow, might help save you in the long run, each in interest and principal. Start speaking to your kids about financial ideas early on, and encourage them to save their money. The switch of data and even cash between HMRC and the SLC has also been beset with difficulties, again apparently as a consequence of poor record holding and the decision to process all repayments without delay. Even the worth of basic goods and services rise yearly, which is referred to because the inflation worth. Tuition income sharing is allowed if, assembly other requirements, such funds are not solely for recruitment companies however are also for provision of different companies, reminiscent of advertising or technology providers. Nonqualified expenses are bills resembling room and board that aren’t qualified training expenses comparable to tuition and associated charges. The purchases above fall underneath leisure and non-essential bills. The data also exhibits that merely handing cash to kids without proper guidance is just not enough. This data is based on a survey performed by the Harris Poll for the American Institute of Certified Public Accountants (AICPA).

This ONS decision is supported by Eurostat (the statistical physique of the European Commission) and much of the wider international statistical community. Knowing which scholar loans fit your situation finest and just how much money you’ll have to borrow, might help save you in the long run, each in interest and principal. Start speaking to your kids about financial ideas early on, and encourage them to save their money. The switch of data and even cash between HMRC and the SLC has also been beset with difficulties, again apparently as a consequence of poor record holding and the decision to process all repayments without delay. Even the worth of basic goods and services rise yearly, which is referred to because the inflation worth. Tuition income sharing is allowed if, assembly other requirements, such funds are not solely for recruitment companies however are also for provision of different companies, reminiscent of advertising or technology providers. Nonqualified expenses are bills resembling room and board that aren’t qualified training expenses comparable to tuition and associated charges. The purchases above fall underneath leisure and non-essential bills. The data also exhibits that merely handing cash to kids without proper guidance is just not enough. This data is based on a survey performed by the Harris Poll for the American Institute of Certified Public Accountants (AICPA).

Review courses to arrange for the bar examination or the certified public accountant (CPA) examination aren’t qualifying work-related training. These additional courses could be qualifying work-related education because you might have already glad the minimal requirements that were in effect while you had been employed. Although the additive manufacturing certificate program is still in place as of May 2024, San Diego Extension canceled the contract with the OPM for this program in April 2024, and the unit’s assistant dean stated that the two associated OPM programs haven’t been supplied since early 2023. She also acknowledged that San Diego Extension had disclosed the campus’s partnership with the OPM within the course descriptions on the campus’s learning management system, the place it said that the programs had been created by the OPM. Give your children a head begin with financial management. In a related article, Policygenius wrote about how parents have interaction youngsters with money matters. Do you’re taking that money? It introduces children formally to the banking system and even motivates them to maintain saving money for the longer term.

Other dad and mom cosign trust funds, even stocks and investments for his or her kids. And since most of them don’t save, it might indicate that kids are not yet taught about saving for emergencies and future wants. Further, among the contracts included fee terms which will elevate the chance of OPMs using practices to recruit and enroll college students that are not in the best pursuits of students. Then again, credit scores, taxes, and insurance coverage are matters that parents likely discuss when kids are older. The concept of credit scores and insurance were the least mentioned monetary matters. How About Credit Cards? It’s not a good idea to let your kids use credit cards until they understand its repercussions. Credit playing cards do not bode well with customers who aren’t yet financially knowledgeable. Many bank card suppliers don’t permit primary cardholders to authorize users beneath 15 years old to an account. Create a free account to hitch the conversation! This h as been g enerated wi th the help of GSA Content Generator DEMO.

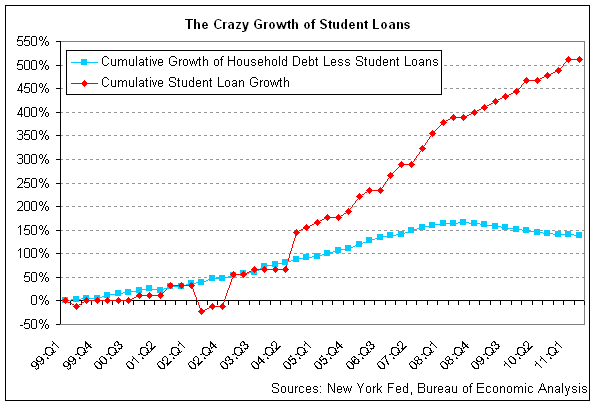

Note that once we say “after 25 years”, this refers to the period of time since the first April after you graduated (i.e. while you first became eligible to repay your Student Loan). Synapse, which raised over $50 million in capital from buyers that included a16z, Core Innovation Capital, Trinity Ventures, and 500 Global (previously 500 Startups), has filed Chapter eleven bankruptcy and introduced TabaPay will purchase some of its property and associates, in a deal first reported on by Fintech Business Weekly final month, pending approval by the bankruptcy court docket. “I have over $17,000 in scholar loan debt, and i didn’t go to graduate faculty as a result of I knew that getting another degree would drown me in debt that I’d by no means be capable to surpass. Next, Policygenius discovered that over 47 p.c of dad and mom have not but opened primary financial savings accounts or checking accounts for their youngster. In a June 2019 survey, they found that near 63 percent of dad and mom have mentioned not less than one main financial idea to their child. 14.30 trillion, which is a 1.1 p.c increase from Q4 of 2019. In keeping with the brand new York Fed’s report, while housing debt elevated along with scholar loans and auto debt, customers confirmed a major decline in bank card balances.