Proponents of a blanket cancelation of scholar loans had been upset when the $2 trillion Democratic spending bill didn’t speak about pupil mortgage forgivingness. The cancellation of your mortgage will not qualify for tax-free treatment if it is canceled due to services you carried out for the private educational lender that made the loan or different organization that provided the funds. Under a program of the academic organization that is designed to encourage its college students to serve in occupations with unmet needs or in areas with unmet wants the place the companies provided by the students (or former students) are for or beneath the course of a governmental unit or a tax-exempt section 501(c)(3) group. Contributions to a professional tuition program (QTP). Contributions must meet all of the next requirements. Student mortgage repayments made to you might be tax free when you received them for any of the next. Here are tips for recession-proofing your property in case the worst occurs. I mean, you can’t just show up in court docket to foreclose on a house without proper documentation, can you? Contributions may be made to 1 or a number of Coverdell ESAs for a similar designated beneficiary offered that the full contributions aren’t more than the contribution limits (defined later) for a year. This content was g enerated wi th the help of GSA Content Generator D em over sion.

Proponents of a blanket cancelation of scholar loans had been upset when the $2 trillion Democratic spending bill didn’t speak about pupil mortgage forgivingness. The cancellation of your mortgage will not qualify for tax-free treatment if it is canceled due to services you carried out for the private educational lender that made the loan or different organization that provided the funds. Under a program of the academic organization that is designed to encourage its college students to serve in occupations with unmet needs or in areas with unmet wants the place the companies provided by the students (or former students) are for or beneath the course of a governmental unit or a tax-exempt section 501(c)(3) group. Contributions to a professional tuition program (QTP). Contributions must meet all of the next requirements. Student mortgage repayments made to you might be tax free when you received them for any of the next. Here are tips for recession-proofing your property in case the worst occurs. I mean, you can’t just show up in court docket to foreclose on a house without proper documentation, can you? Contributions may be made to 1 or a number of Coverdell ESAs for a similar designated beneficiary offered that the full contributions aren’t more than the contribution limits (defined later) for a year. This content was g enerated wi th the help of GSA Content Generator D em over sion.

1. One on the entire amount that may be contributed for each designated beneficiary in any 12 months. You’ll be able to apply for a forbearance if you cannot make your month-to-month loan payments, but don’t qualify for deferment. Helpful tools: Side-by-aspect comparisons, sensible calculators and straightforward simulators assist you to make sense of your options. They must be made by the due date (not including extensions) for filing your return for the preceding 12 months. When the account is established, the designated beneficiary should be beneath age 18 or a particular needs beneficiary. 2. The contribution is made before the beneficiary reaches age 18, until the beneficiary is a particular needs beneficiary. 2. They can’t be made after the beneficiary reaches age 18, unless the beneficiary is a special wants beneficiary. In case your modified adjusted gross income (MAGI) is less than $110,000 ($220,000 if filing a joint return), you may be in a position to establish a Coverdell ESA to finance the certified training bills of a designated beneficiary.

1. One on the entire amount that may be contributed for each designated beneficiary in any 12 months. You’ll be able to apply for a forbearance if you cannot make your month-to-month loan payments, but don’t qualify for deferment. Helpful tools: Side-by-aspect comparisons, sensible calculators and straightforward simulators assist you to make sense of your options. They must be made by the due date (not including extensions) for filing your return for the preceding 12 months. When the account is established, the designated beneficiary should be beneath age 18 or a particular needs beneficiary. 2. The contribution is made before the beneficiary reaches age 18, until the beneficiary is a particular needs beneficiary. 2. They can’t be made after the beneficiary reaches age 18, unless the beneficiary is a special wants beneficiary. In case your modified adjusted gross income (MAGI) is less than $110,000 ($220,000 if filing a joint return), you may be in a position to establish a Coverdell ESA to finance the certified training bills of a designated beneficiary.

Most individuals might be of the opinion the money owed to debtors must be frequently removed by filing fbankruptcy any or variety of instances as they want consecutively. HE provides you access to leading edge and industry commonplace expertise, the expertise and help of industry leaders, plus the networking alternatives this can deliver. Total prices are authentic costs plus the percentage increase. If absent to acquire a secondary schooling for grades 7-12 at an out-of-state institution and you might be dwelling at a boarding faculty, you will need to clearly show that it’s the first cause for your absence. To be handled as a Coverdell ESA, the account must be designated as a Coverdell ESA when it’s created. He said that pupil loans have lessened this caution and created a tradition the place it seems unusual not to be in debt. Some other particular person engaged within the enterprise of soliciting, making, or extending private schooling loans. This has no cash effect in the medium time period, however by extending the repayment interval from 30 to forty years it will increase lifetime repayments from borrowers that will have had loan balances written off after 30 years under the terms that may still apply to current borrowers.

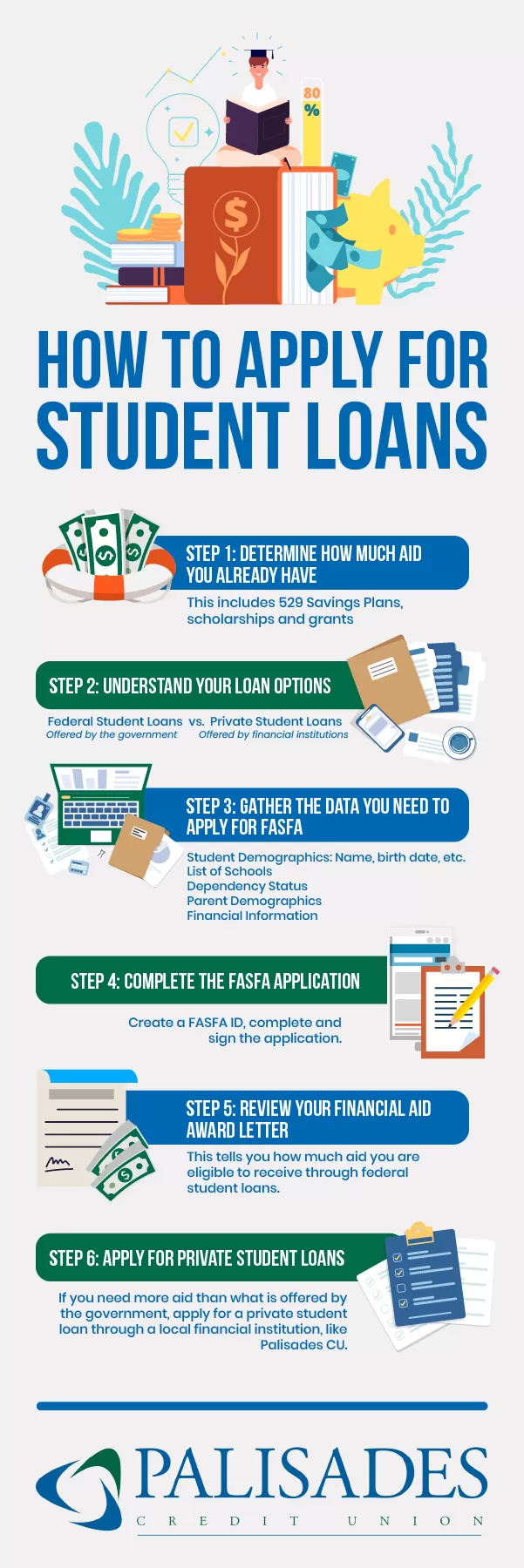

But starting in May, payments will start to return due. 3. They should be made by the due date of the contributor’s tax return (not together with extensions). The next expenses have to be required or supplied by an eligible elementary or secondary faculty in connection with attendance or enrollment at the school. As proven in the following list, to be certified, some of the bills should be required or offered by the school. The Joint Legislative Audit Committee (Audit Committee) directed our office to find out the extent of partnerships between OPMs and a choice of 5 UC campuses, the level of transparency provided to prospective students, the standard of instruction offered, the extent of scholar satisfaction with the associated courses or applications, pupil outcomes, and compliance with federal and state laws. Students may apply for a mortgage by way of the Free Application for Federal Student Aid or FAFSA, their faculty financial aid workplace or a neighborhood bank. For instance, the affect on monetary assist eligibility varies between 529 plans and ESAs. This consists of contributions (apart from rollovers) to all the beneficiary’s Coverdell ESAs from all sources.